Integrated and Sustainable Credit Union Networks

ACCU works in partnership with its members to strengthen and promote credit unions as effective instruments of socio-economic development of the people

The savings and credit cooperative was introduced to Asian countries by the British colonial government as solution to the rural credit in India and Sri Lanka more than 100 years ago. Even before they had fully consolidated in Germany, cooperatives began spreading in some countries of Asia. In Thailand, cooperatives were introduced in 1915 and in the Philippines in 1892.

Credit unions had a turning point in the 1960s when for the first time; the credit union training was conducted in Bangkok, Thailand by Social Economic Life of Asia (SELA). The conference was attended by young enthusiastic leaders across Asia who later on pioneered credit unions in their respective countries.

The Training cum seminar was very comprehensive and extensive covering those subjects as social and economic significance of credit unions, credit union philosophy and principles as well as credit union management.

In collaboration with the Philippine Credit Union League (now Philippine Federation of Credit Cooperatives or PFCCO), CUNA (stands for Credit Union National Association in the USA) International organized the 1st training on Credit Union Development Course in Asia in 1961 in Baguio City, Philippines. The training brought together 25 delegates in 12 countries. As follow up of the training, credit unions principle philosophy and ideas were spread all over Asian countries resulting to establishment of first credit union in the Republic of China (Taiwan) in 1963, Hong Kong in 1964, Japan and Thailand in 1965, Malaysia and Vietnam in 1966, and Indonesia in 1970. Korea had already started the first credit union in 1960. Having established credit unions, the Philippine Credit Union League was established in 1960.

The same number of countries attended the second training organized with the Ministry of

Agriculture and

Cooperatives and Kasetsart University in October, 1965. The most attended was the third course conducted

at

Xavier University in Cagayan De Oro City in the Philippines in April 1969. It drew nearly 100 delegates

from

15 countries in Asia including the World Council of Credit Unions (WOCCU) which was formed on the same

year.

Delegates realized the importance of having a regional body for credit unions to provide platform for

sharing experience and learning among Asian credit unions. The training then concluded in the

appointment of

a Planning Committee mandated to plan for the establishment of the Asian Confederation of Credit

Unions.

On April 28, 1971, delegates from 9 Asian countries - Japan, Hong Kong, Korea, Malaysia, the Philippines, Indonesia, Taiwan, Thailand, and South Vietnam came to Seoul, Korea to fulfill an individual collective dream - to cooperate with neighbors for the good of all. The representatives convened to assist and support the Planning Committee in developing the necessary requisites towards the formation of the confederation - an alliance of actual credit union centers leagues, federations of Asian countries with the mission to assist members to organize, expand, improve and integrate credit unions so they can fulfill their potential as effective instruments for the development of people in Asia. The Asian Confederation of Credit Unions or ACCU for short was officially formed.

After the 4th Asian Regional Credit Union Training Seminar, the confederation held the Inauguration Meeting at the Cooperative Education Institute in Seoul. The meeting enacted the bylaws and approved the series of meetings of the Planning Committee. On that momentous day, the national leagues in Asia transferred their membership from WOCCU to ACCU.

Having already formed their national leagues, five of the nine Asian countries Japan, Hong Kong, Korea, the Philippines, and Taiwan became the founding members of the confederation. The first year membership dues received was US$ 91 from the five founding members.

The Board Meeting of WOCCU held in Minneapolis, Minnesota, USA on May 19, 1971 approved the membership of ACCU. The certificate of membership reads: "ACCU is accepted in the worldwide credit union movement and is a participant in all programs and provided by WOCCU Inc. services."

The affiliation entitled the members of ACCU to WOCCU services such as training programs, and technical support in feasibility studies, developing institutional growth development plans, and legal assistance that leads to the registration of national leagues and federations with their governments. The following year, Augustine J. R. Kang representing ACCU at WOCCU Board Meeting in Halifax, Canada, put the young ACCU into the world map of credit unions.

Seconded by WOCCU, the Board of Directors appointed Augustine Kang, Jr. as the first General Manager of ACCU. From 1971 to 1982, ACCU office had been based in Seoul with the office provided by the National Credit Union Federation of Korea. In 1983, the ACCU office was moved to Thailand and a new General Manager Mr. Somchit Supabanpot was appointed who served until 1994. He was replaced by the current Chief Executive Officer Ranjith Hettiarachchi.

The Credit Union League of Thailand provided an office space for ACCU from 1983 to 1988.

The

confederation

bought a five storey building in 1989 for its office and had used this building until May 2010.

ACCU operates as a regional representative organization of credit unions and similar cooperative financial institutions in the region of Asia. ACCU is representing 40.2 million individual members from more than 45,000 credit unions in 22 countries in Asia.

ACCU is owned by its member organizations. Member categories are:

General Meeting: is composed of the official delegate from member organizations. The regular members have voting right and thus can be elected in the Board.

Board of Directors: the General Meeting elects five (5) Directors from the voting

regular members to

oversee ACCU business. Those elected by the General Meeting shall elect among themselves: President,

First

Vice-President, Second Vice-President, Secretary, and Treasurer. The Chief Executive Officer shall act

as an

ex officio member without voting power. The Board of Directors shall be in their positions for two

years.

Each individual should not hold more than three consecutive terms.

ACCU has been instrumental in the promotion of credit unions in Asia. The following is the milestones of credit unions in Asia:

ACCU has been instrumental in the promotion of credit unions in Asia. The following is the milestones of credit unions in Asia:

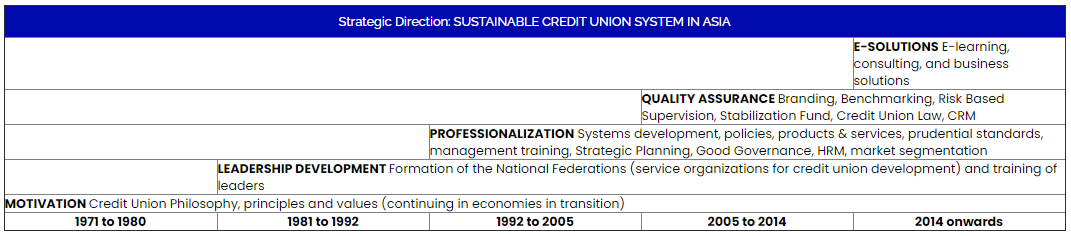

ACCU role has evolved since its inception in 1971 based on the development of

credit union

movements in

Asia. The following table explains the evolution of ACCU role:

From 1971 to 1980, ACCU services were focused on introducing the credit union philosophy and principles to Asian countries. Annually, ACCU organized training to educate promoters of credit unions which led to the spread of credit unions in Asian countries. Except for the five founding members of ACCU (Japan, Hong Kong, Korea, Philippines and Taiwan), other federations that have become members of ACCU were formed during this period such as Bangladesh, Indonesia, Papua New Guinea, Thailand, Malaysia, Nepal, India and Sri Lanka.

The promotion of credit unions and building connections are an ongoing support for economies in transition (either from central economy or conflict) such as Cambodia, Lao PDR, Mongolia, Timor Leste, Pakistan and Vietnam.

Aimed at building human capital, ACCU offered an intensive leadership course on credit union management and Field Organizers training during 1981 to 1992. Many of those who were trained are still serving the credit union movement in their countries and internationally to some extent. Besides the ACCU sponsored training programs, cooperation among member organizations blossomed. Members of ACCU demonstrated their enthusiasm to learn from each other and share resources through exposure and internship programs between countries.

The decade is considered as the peak of business solutions development aimed to professionalize the credit union operation. In 1998, ACCU implemented the project on Institutional Development of Credit Unions in Asia (INDECUA) that raised the level of awareness of leaders on the need to professionalize the credit union operation to meet the challenges of globalization. From this project, ACCU has evolved its role from merely technical assistance provider to business solutions developer. All the solutions developed have been proven to be valuable to credit unions.

ACCU steps up to guarantee the value and differentiation of credit unions in the marketplace by developing systems of quality control. Tools such as ACCESS (stands for A1 Competitive Choice for Excellence in Service and Soundness) Branding, Risk Based Supervision, Stabilization Fund, Web-based Benchmarking Service and Governance Framework assist credit unions to raise its market performance and heighten its sense of mission.

From 2014 ACCU takes leadership to integrate the credit union networks in Asia. It would mean the federations demonstrating leadership to ensure the viability, growth and sustainability of the network. The federations provide network support in areas of finance, liquidity management, human resource, lending services, marketing, and supervision.

We owe our members a Dynamic Regional Organization. We will strive to expand our human resources by mobilizing competent people who can deliver value-added services to our members in a timely manner.

We owe our members a Leading Organization for Credit Union Innovation in Asia. ACCU will not duplicate what our members are doing. Our services will always be of value to members that use them to help achieve their own goals

We owe our members a Learning Organization for Credit Unions in Asia - this means ACCU will be the resource center or facilitator for credit union best practice, management tools, systems, guidelines and technology.

We owe our members and partners the Highest Quality Service possible at all times characterized by responsiveness, accuracy, integrity and professionalism. We will always strive for quality improvement.

The membership is open to national federation of credit unions/cooperatives/savings and credit cooperatives representing at least 20,000 individual members or 2% of the country's population. The membership is minimum of US$ 2,000 and maximum US$ 5,000 per year computed based on the aggregated movement's assets.

The membership is open to national organization or credit union league or federation which is not yet qualified to become a regular member. Annular due is US$ 1,500.

The membership is open to organizations from both local and abroad promoting and supporting credit union development. The annual dues is US$ 1,000.

Open to any primary credit union willing to participate for international development. The membership would allow accelerated access to information, networking, cooperation among cooperatives and experience sharing at international level. The annual dues is US$ 500.

The General Meeting is the highest policy-making forum of the organization. It is

convened by

ACCU annually, with delegates representing each member credit union league or federation. The General

Meeting

elects five delegates to serve as the Board of Directors. Within the elected Board, they choose the

President,

two Vice Presidents, Secretary and Treasurer. The Board meets twice a year. A team of professional staff

provides technical services and support to members. Specialised groups, such as the CEOs Advisory

Committee,

Task Force on Gender and Development, Future Leaders Task Force, and the Human Resource Development

Committee

meet in conjunction with the General Meeting to give advice on ACCU overall policy and programs and to

review

impacts of ACCU activities.

Younsik Kim represents the Korean credit union movement as the chairperson of the National Credit Union Federation of Korea (NACUFOK). He also served as the President of the National Credit Union Foundation of Korea and president of the Daegu City Credit Union Regional Council. In addition to his leadership role at NACUFOK, Kim is currently the vice chair of the Democratic Party of Korean Policy Committee, the CEO of the Hyosung Agricultural Products Corporation and the CEO of Hotel Ariana. Kim is a graduate of Shingu University and other activities include serving as alumni president of the Maeil News Top Readers Academy and panel judge of the Korea Grand Art Exhibition Calligraphy.

Pol. Maj. Gen. Danukrit Kalampakorn is a seasoned professional with a distinguished career spanning both medical and financial realms. His expertise is further complemented by an MBA degree. As Vice President of the Federation of Savings and Credit Cooperatives of Thailand (FSCT), and a repeatedly elected board member, he has demonstrated unwavering leadership and commitment to the cooperative movement. With over two decades of experience, Kalampakorn's contributions to various projects and services have significantly advanced cooperative initiatives and enhanced financial management within the sector.

Mrs. Lee Chun-Fen is the current Chairperson of the Credit Union League of the Republic of China (CULROC). She is also the Chairperson of Hu-Ai Credit Union and Hualien Chapter, the regional body of CULROC. Her involvement in the credit union movement is more than 30 years. Mrs. Lee has become the first woman ACCU Director from CULROC and the 4th woman Director who served on the ACCU Board. Equipped with ample experience, she is always diligent, passionate, and dedicated to promoting credit union development in Taiwan.Mrs. Lee expects to connect credit unions nationwide to work together internationally, deepening the foundation of cooperation, maintaining a consensus, and overcoming all difficulties ahead.

Soledad V. Cabangis is a former Chairperson and current member of the National Confederation of Cooperatives (NATCCO) Board of Directors. She played a pivotal role in shaping the landscape of credit unions in the Philippines and served as the second Vice President of the Association of Asian Confederation of Credit Unions (ACCU) from 2018 to 2022. Under her guidance, St. Martin of Tours Credit and Development Cooperative achieved remarkable milestones, reaching the One Billion and Two Billion pesos marks in Assets. ACCU recognized the cooperative, bestowing the Bronze accreditation for A-1 Competitive Choice for Excellence in Service and Soundness (ACCESS). Soledad V. Cabangis's professional journey is marked by significant achievements and diverse roles. She graduated with a Bachelor of Laws degree from the Arellano Law Foundation and a Bachelor of Science degree in Psychology from St. Paul College of Manila. These qualifications allowed her to contribute to the next generation of legal professionals as a law professor at Dr. Yanga's Colleges, Inc. and Mapua University, showcasing her commitment to education and mentorship. She manages a department at the National Transmission Corporation and teaches law at prestigious universities. However, her most fulfilling roles were those that defined her as a person: daughter, wife, and mother.

Dr. WARA SABON DOMINIKUS, M.Sc., is the Chairman of the Credit Union Central of Indonesia (CUCO) and a Lecturer in the Education Mathematics Department at the University of Nusa Cendana Kupang, NTT, Indonesia. Since he was young, he has been active in the development of Credit Unions in Kupang NTT. Starting in 2001, he was on the board of directors of Serviam Credit Union and PuskopditBekatigade Timor. Dominikus has a strong background in facilitating training programs for credit unions. His expertise spans various areas: Governance and Leadership, Cooperative Management, Supervisory Management, Financial Management, and credit union promotion. His extensive experience covers a range of institutions, including credit unions, government agencies, andcooperative departments. This breadth of experience instills confidence in his abilities and knowledge.

Leni (her nickname) joined the Association of Asian Confederation of Credit Unions on February 1995 as Manager for Member Services responsible to assist ACCU member organizations in developing and improving their movement's institutional capacity.

She assumes greater responsibilities for the Asian credit union movement starting September 1, 2014 as she has been appointed as the new Chief Executive Officer of ACCU after the retirement of the current CEO, Ranjith Hettiarachchi.

Southeast and South Asia have been the destination of Leni's travel since 1995 where she is concentrating much in helping ACCU member organizations in reaching to the poor, professionalization, quality assurance and now integration.

She is in-charge in developing programs according to the present needs of ACCU member organizations and credit unions. As ACCU is a think tank organization for credit unions, Leni's main task is developing credit union business solutions in response to credit union current and perceived challenges. ACCU now offers 21 Credit Union business solutions for members.

As a Certified Public Accountant, she was providing external auditing service, and management advisory services to both credit unions/cooperatives and private business entities from 1990 to 1994. Leni also joined the academe for one year as a CPA Reviewer before she came to work with ACCU. She completed a certificate course on Women's Executive Leadership Program at the Center for Executive Education at the University of California Berkeley in USA in July 2014.

Leni is a graduate of the 13th Australian Development Education Workshop in the year 1997. Inspired with the DE experience, ACCU and the Credit Union Foundation Australia, started the Asian Development Education Program in 1999. The Asian DE has gained high approval from more than 600 leaders and professionals who are certified since 1999. Leni is serving as the DE Administrator for Asia and also received the I-CUDE (International Credit Union Development Educator) designation given by the World Council of Credit Unions.

| Year | Country | Awardees | |

|---|---|---|---|

| 2010 | Nepal | Bindabasini Saving & Credit Co-operative Society Ltd. | |

| 2010 | Philippines | Paglaum Multi-Purpose Cooperative | |

| 2011 | Bangladesh | Baridhara Mohila Samobaya Samity Ltd. | |

| 2012 | India | Buldana Urban Credit Co-operative Society Ltd. | |

| 2012 | Nepal | Sahara Nepal Savings and Credit Cooperative Society Ltd. | |

| 2013 | Nepal | Nawaprativa Saving and Credit Cooperative Society Ltd. |

| Year | Country | Awardees | |

|---|---|---|---|

| 2023 | Indonesia | Credit Union SauanSibarrung |

| Year | Country | Awardees | |

|---|---|---|---|

| 2019 | Philippines | Tagum Cooperative | |

| 2023 | Indonesia | Credit Union SauanSibarrung |

| Year | Country | Awardees | |

|---|---|---|---|

| 2018 | Philippines | San Jose del Monte Savings and Credit Cooperative | |

| 2018 | Philippines | Tagum Cooperative | |

| 2018 | Nepal | Janasachetan SACCOS | |

| 2018 | Nepal | Bindabasini SACCOS | |

| 2018 | Nepal | Samudayik SACCOS | |

| 2018 | Nepal | Kalyankari SACCOS | |

| 2018 | Nepal | Milijuli SACCOS | |

| 2018 | Indonesia | Credit Union SauanSibarrung | |

| 2019 | Nepal | Janautthan SACCOS | |

| 2019 | Nepal | Manakamana SACCOS | |

| 2019 | Nepal | Janakalyan SACCOS | |

| 2023 | Nepal | Chandeshwori SACCOS |

| Year | Country | Awardees | |

|---|---|---|---|

| 2017 | Philippines | Manatal Multi-Purpose Cooperative | |

| 2017 | Philippines | San Jose del Monte Savings and Credit Cooperative | |

| 2017 | Philippines | St. Martin of Tours Credit and Development Cooperative | |

| 2017 | Philippines | Tagum Cooperative | |

| 2017 | Nepal | Janasachetan Saving & Credit Cooperative Society Ltd. | |

| 2017 | Nepal | Bindabasini Saving & Credit Co-operative Society Ltd. | |

| 2017 | Nepal | BudolSamudayik Saving & Credit Cooperative Society Ltd. | |

| 2017 | Nepal | Siddhi Ganesh Saving & Credit Cooperative Society Ltd. | |

| 2017 | Nepal | Samudayik Saving & Credit Cooperative Society Ltd. | |

| 2017 | Nepal | VYCCU Saving & Credit Cooperative Society Ltd. | |

| 2017 | Nepal | Kisan Saving & Credit Cooperative Society Ltd. | |

| 2017 | Nepal | Subhakamana Savings and Credit Cooperative Society Ltd. | |

| 2017 | Indonesia | Credit Union Sauan Sibarrung | |

| 2017 | Nepal | Mahila Savings and Credit Cooperative Society Ltd. | |

| 2017 | Nepal | Kalyankari Savings and Credit Cooperative Society Ltd | |

| 2017 | Nepal | Hamro Janakalyan Savings and Credit Cooperative Society Ltd | |

| 2017 | Nepal | Scope Savings and Credit Co-operative Society Ltd. | |

| 2017 | Nepal | Kishan Kalyan Savings and Credit Cooparetive Society Ltd. | |

| 2017 | Nepal | Upakar Savings and Credit Cooperative Society Ltd | |

| 2017 | Nepal | Itahara Savings and Credit Cooperative Society Ltd | |

| 2017 | Nepal | Shree Barahi Savings and Credit Cooperative Ltd. | |

| 2017 | Nepal | Gaindakot Swabhiman Savings and Credit Cooperative Society Ltd | |

| 2017 | Nepal | Milijuli Savings and Credit Cooperative Society Ltd | |

| 2017 | Nepal | Manakamana Savings and Credit Cooperative Society Ltd | |

| 2019 | Nepal | Chandeshwori SACCOS | |

| 2019 | Nepal | Damravitta SACCOS | |

| 2019 | Nepal | KoliyaDevdaha SACCOS | |

| 2019 | Nepal | Paropakar SACCOS | |

| 2019 | Nepal | Siko SACCOS | |

| 2019 | Nepal | Gramin SACCOS | |

| 2022 | Philippines | Oro Integrated Cooperative |

ACCU's repertoire of Product and Services were developed to meet the needs of our members in the following areas;

| Year | Country | Awardees | |

|---|---|---|---|

| 1989 | Indonesia | Mr. Robby Tulus | |

| 1990 | Korea | Mr. Michael Lee-Sang Ho | |

| 1990 | Taiwan R.O.C | Mr. Chen Wang-Shong | |

| 1991 | Taiwan R.O.C | Mr. Mathew Wang Wu | |

| 1992 | Thailand | Mr. Weera Namwong | |

| 1993 | Taiwan R.O.C | Mr. Hsieh Wen-Yih | |

| 1994 | Hong Kong | Mr. Andrew So Kwok-Wing | |

| 1995 | Korea | Mr. John Sung-Ho Park | |

| 1997 | Thailand | Mr. Sming Jongasikit | |

| 1998 | Korea | Mr. Kwang-Bo Son | |

| 1999 | Indonesia | Mr. Ibnoe Soedjono | |

| 2001 | Thailand | Assoc. Prof. Sawat Saengbangpla | |

| 2002 | Australia | Mr. Grahame Mehrtens | |

| 2003 | Sri lanka | Mr. P.A. Kiriwandeniya | |

| 2004 | Philippines | Atty. Mordino R. Cua | |

| 2005 | Thailand | Dr. Amporn Wathanavongs | |

| 2006 | None | None | |

| 2007 | Korea | Mr. Lee Han-woong | |

| 2008 | Thailand | Mr. Supachai Srisupaaksorn | |

| 2009 | Philippines | Hon. Guillermo (Posthumous) | |

| 2011 | Philippines | Mr. Cresente "Cris" Paez, Sr. | |

| 2011 | Korea | Mr. Augustine K. Lim | |

| 2013 | Thailand | Dr. Chalermpol Dulsamphant | |

| 2014 | None | None | |

| 2015 | Taiwan R.O.C | Chuang Chin-Sheng | |

| 2016 | Korea | Oh-Man Kwon | |

| 2017 | Thailand | Anan Chatrupracheewin | |

| 2018 | None | None | |

| 2019 | None | None | |

| 2020 | None | None | |

| 2021 | None | None |

| Year | Country | Awardees | |

|---|---|---|---|

| 1999 | Germany | MISEREOR | |

| 1999 | The Netherlands | Cordaid | |

| 2001 | Australia | Credit Union Foundation Australia | |

| 2002 | Canada | Canadian Co-operative Association | |

| 2003 | Ireland | Irish League of Credit Unions | |

| 2004 | The Netherlands | Agriterra | |

| 2005 | Philippines | South East Asian Rural Social Leadership Institute | |

| 2006 | None | None | |

| 2007 | The Netherlands | Rabobank Foundation | |

| 2008 | The Netherlands | Cordaid | |

| 2009 | Canada | Coady International Institute | |

| 2013 | Canada | Développement international Desjardins (DID) | |

| 2014 | None | None | |

| 2015 | Australia | 10 Supporter Members from Australia | |

| 2016 | USA | United Nations Capital Development Fund (UNCDF) | |

| 2017 | Korea | National Credit Union Federation of Korea (NACUFOK) | |

| 2018 | Thailand | The Federation of Savings and Credit Cooperatives of Thailand Ltd. (FSCT) | |

| 2019 | None | None | |

| 2020 | None | None | |

| 2021 | None | None |

| Year | Country | Awardees | |

|---|---|---|---|

| 2021 | Nepal | Mr. Yagya Raj Dhungel |

| Year | Country | Awardees | |

|---|---|---|---|

| 2021 | Nepal | Mr. Khil Bahadur Syangtan (K.B. Lama) |

Asian Confederation of Credit Unions (ACCU)

Location: Bangkok, Thailand

Application Deadline:

August 15, 2025

The Association of Asian Confederation of Credit Unions (ACCU) seeks a highly accomplished and visionary leader to join our team as Chief Operating Officer (COO). This strategic role serves as a steppingstone to the Chief Executive Officer (CEO) position, with the successful candidate expected to transition into the CEO role after one year, pending performance evaluation and Board approval.

ACCU is a regional organization that champions the growth and sustainability of credit unions and cooperative financial institutions across Asia. With a steadfast commitment to financial inclusion, cooperative values, and long-term development, we empower communities and institutions to create a more resilient and equitable financial landscape through financial cooperatives.

The CEO position is an exceptional leadership opportunity to shape the future of cooperative finance in Asia and drive impactful changes on a regional scale.

Key Responsibilities:

As Chief Operating Officer (COO), you will play a pivotal role in shaping ACCU’s future, working closely with the CEO and Board of Directors to oversee operations, strategic initiatives, and member services. Your leadership will be instrumental in advancing ACCU’s mission and vision.

Key Responsibilities:

Qualifications and Experience:

We are looking for a candidate with the following qualifications and experience:

Why Join ACCU?

Application Process:

Candidates under the age of 50 are encouraged to submit their applications, including:

Please send your application to accumail@aaccu.coop by August 15, 2025, addressed to.

The President ASSOCIATION OF ASIAN CONFEDERATION OF CREDIT UNIONS 5th Floor FSCT Building No. 199, Nakornin Rd. (Rama V), Bangsrithong Sub-District, Bangkruay District, Nonthaburi Province 11130, THAILAND Email: accumail@aaccu.coop Tel: +662-496-1262 and +662-496-1264 Fax: +662-496-1263

The Association of Asian Confederation of Credit Unions (ACCU), an international organization with operations in 23 Asian countries with its headquarters in Bangkok, is excited to announce an employment opportunity for a Manager, Training and Development role.

We seek dynamic and motivated individuals to become part of our team and embark on an inspiring journey of growth and achievement. At ACCU, our unwavering commitment lies in fostering a culture of innovation and excellence.

Our mission is to advocate for and enhance cooperative financial institutions that positively impact people's lives in Asia. We are searching for team members whose personal aspirations resonate with the core of our mission, as this alignment is essential for a gratifying professional journey.

Our success results from our team members' skills, commitment, and diverse backgrounds, and we are eager to welcome outstanding individuals to join us on this thrilling adventure.

The above qualifications and experience are essential for the successful candidate to excel in their role at our organization.

Chief Executive officer

Association of Asian Confederation of Credit Unions

5th Floor FSCT Building

No. 199, Nakornin Rd. (Rama V), Bangsrithong

Sub-District, Bangkruay District, Nonthaburi Province 11130

Tel: +662-496-1262 and +662-496-1264

Fax: +662-496-1263 Email: accumail@aaccu.coop

A co-operative is a group of people acting together to meet the common needs and

aspirations

of its members, sharing ownership and making decisions democratically. Co-operatives are not about

making

big profits for shareholders, but creating value for customers this is what gives co-operatives a unique

character, and influences value and principle Co-operative businesses are owned and run by and for their

members, whether they are customers, employees or residents. As well as giving members an equal say and

share of the profits, co-operatives act together to build a better world. Co-operatives are a flexible

business model. They can be set up in different ways, using different legal structures, depending on

what

works for the members. The definition of a co-operative business is that they are owned and run by the

members - the people who benefit from the co-operative's services. Although they carry out all kinds of

business, all co-operative businesses have core things in common.

Co-operatives want to trade successfully they are businesses, not

charities, after all. Members, such as farmers or freelancers, tenants or taxi drivers,

can often do better by working together. And sharing the profit is a way to keep it fair

and make it worthwhile. Rather than rewarding outside investors, a co-operative shares

its profits amongst the members.

Co-operatives are a business model that exists to serve its

members, whether they are the customers, the employees, or the local community. The

members are the owners, with an equal say in what the co-operative does.

As well as getting the products and services they need, members help shape the decisions

their co-operative makes. Across the world co-operatives are owned by 1 Billion people

and these numbers keep on growing.

This mix of self-help and mutual aid has made co-operative business an international

force

for good. 100 million people around the world are employed by co-operatives, whilst nearly 1

billion are members.

A Credit Union is a co-operative financial institution, that is owned and controlled by its members and operated for the purpose of promoting thrift, providing credit at reasonable rates, and providing other financial services to its members.

In many countries, the financial industry is dominated by commercial or government-controlled banks that help implement monetary policies set by a government agency. Credit Unions are different in that they serve the needs of individuals. Most private sector financial institutions are controlled by investors in making a profit on the services offered to user/customers. In Credit Unions, the user/customer is also the owner. All profits made on services offered belong to the membership. Member ownership contributes to the ability to operate soundly while charging affordable rates and serving people other organizations consider unprofitable.

A Savings and Credit Cooperative (SCC) is a group of people who join together to pool their savings and make loans to each other at reasonable rates of interest that cover all costs and provide for adequate sized reserves. The group also aims to educate its members on the wise use of money so they can improve their lives.

To make the process easier, the group maintains a business structure a cooperative which functions as an intermediary between savers and borrowers. The members of the group own and control the organization.

SCCs are organized to serve one or more groups of people who have something in common. Everyone who shares the common bond qualifies to join the SCC. They are part of its field of membership. To become a member, a person must purchase one ownership share. Each SCC should be independent and financially self sustainable with an obligation to put the best interests of its members over any other concerns.

A SCC uses its member's shares and deposits to fund loans. So it pays savers for the use of their money. This payment is both a fair return for that use and an incentive to save more. As the pool of savings grows, more loans can be made, more income can be generated, and more members can be served.

The people who borrow from the pool pay interest for the use of the money. This interest is the SCC's main source of income. Total income must cover the return paid to savers, the SCC's operating expenses, and reserves for financial stability. It may also fund education programs and additional financial services. Most SCCs identify the benefits they want to offer, then set about earning the income needed to fund them.

SCCs are frequently considered as "non-profit" organizations. By definition these organizations keep only enough income to cover current operating expenses. For SCCs this strategy would amount to self-destruction. It doesn't allow for expansion or additional benefits when the membership grows and changes. And it doesn't allow for the losses that inevitably occur, but which are difficult to predict in advance.

What makes a SCC non-profit is that all surplus funds are returned to the members in one way or another. Most often the "return" is in the form of benefits such as lower loan rates, additional services, larger provisions against loss, or new equipment that permits better service. After a SCC has met its other goals, it may give any remaining surplus back to the members as share dividends.

A SCC is also non-profit in the sense that its purpose is to serve the members, not to make money. It needs money to provide services and benefits. In fact, it must be very careful to operate on a sound financial basis. But money is the means, not the end itself.

The first step in using money effectively is to accumulate savings for expected and unexpected demands. When something comes up, savings may cover the entire amount needed or may help the member secure financing. SCCs encourage members to save regularly, even if the amount they can set aside is small. Time and again it has been proven that even people with very little income are able to save something.

SCCs use member's savings to make loans to members who need capital for productive purposes. SCCs pay a fair return to savers for the use of their money. The rate paid should be based on SCC costs and the market savings rates and should not be well in excess of the market rate so as not to attract additional funds for which the SCC has no use.

To protect member's savings, SCC loans must be made on a sound basis, with very high expectations that borrowers will meet their obligations. Because the SCC mission is service, SCCs often make small loans that other organizations would dismiss as unprofitable. The SCC must be satisfied that a borrower will have enough income to make the payments and will use credit analysis to determine the borrower has the ability to repay as described in the loan contract.

The loan interest rates charged at SCCs are generally affordable; they should cover SCC costs and compare to average loan rates available at other similar financial institutions. SCC loan rates increase or decrease according to the market.

With a good understanding of financial matters, members can use their money more effectively. So education is another important part of the SCC tradition. SCCs help members understand why savings is important and how to use credit wisely. Seminars may address these or other special topics including improving wage-earning skills and credit rehabilitation.

The Hands and Globe logo has symbolic and historic significance for the Credit Union Movement. The cupped hands symbolize both the financial security and support offered by the international Credit Union network, as well as the fact that the success of the Movement is in the hands of its members.

The globe symbolize the worldwide scope of the Movement and suggests the impact that a truly united Movement can have on the financial development of all countries. The people within the globe represent the real focus of the Credit Union Movement. It is the human element - the harmony of people working for people - that distinguishes Credit Unions from other financial institutions.

Co-operatives are based on the values of self-help, self-responsibility, democracy, equality, equity and solidarity. In the tradition of their founders, co-operative members believe in the ethical values of honesty, openness, social responsibility and caring for others.

Co-operatives are voluntary organisations, open to all persons able to use their services and willing to accept the responsibilities of membership without gender, social, racist, political or religious discrimination.

Co-operatives are democratic organisations controlled by their members, who actively participate in setting their policies and making decisions. Men and women serving as elected representatives are accountable to the membership. In primary co-operatives, members have equal voting rights (one member, one vote) and co-operatives at other levels are also organised in a democratic manner.

Members contribute equitably to and democratically control the capital of their co-operative. At least part of that capital is usually the common property of the co-operative. Members usually receive limited compensation, if any, on capital subscribed as a condition of membership. Members allocate surplus for any or all of the following purposes;

Co-operatives are autonomous, self-help organisations, controlled by their members. If they enter into agreements with other organisations, including governments or raise capital from external sources, they do so on terms that ensure democratic control by their members and maintain their co-operative autonomy.

Co-operatives provide education and training for their members, elected representatives, managers and employees so they can contribute effectively to the development of their co-operatives. They inform the general public, particularly young people and opinion leaders, about the nature and benefits of co-operatives.

Co-operatives serve their members most effectively and strengthen the co-operative movement by working together through local, national, regional and international structures.

Co-operatives work for the sustainable development of their communities through policies approved by their members.